Can Cable TV Survive the Hulu Era?

Is cable TV about to go the way of UHF? Data culled by the Pew Research Center estimates that 22 percent of American adults have cut back or canceled cable within the past year, and within that group, 32 percent have connected their computers to their TVs to view Web video. Not surprisingly, cable TV providers such as Cablevision and Comcast have begun to take notice, and are rolling out their own online video services in response.

"I no longer pick between the TV screen or my laptop screen—my computer serves double duty," said Twanna Hines, a 34-year-old, New York City-based relationship writer and blogger, who traded in cable television for online video this past spring. "I don't even own a television anymore." When Hines is in need of a visual diversion, she points her browser toward Hulu or YouTube. In fact, she's considering purchasing a large-screen monitor to recreate the experience of watching programming on TV. And Hines isn't alone.

Time Warner Cable, the nation's second-largest cable operator, lost 119,000 basic video customers in the fourth quarter of 2008, as the economic downturn caused consumers to second-guess the necessity of premium TV. And although cable companies are doing their best to dangle Triple Play discounts (which includes cable, Internet, and phone service for a low price), some customers are just fed up. Lauren Fairbanks, a 25-year-old blogger who writes about budget living, believes that these deals aren't enough to entice her to sign up for paid TV ever again. "It's just too much to pay for TV," she said. "Cable companies are greedy bastards." Unfortunately, thanks to the continuing online ad slump—and the fact that broadcasters are searching for new ways to monetize their content—the free online TV party may not last much longer. Growing Online Audience There's more legitimate television and movie programming available online, and for free, than at any other time in the Web's relatively brief history. You can watch the latest episode of Lost on ABC.com the day after it airs, catch up with back episodes of 30 Rock on Hulu, and follow the adventures of Star Trek's Captain James T. Kirk on YouTube.

Hulu, the 2007 joint project between Disney, NBC Universal, News Corporation, and Providence Equity Partners, has experienced tremendous growth, according to data compiled by Nielsen Online. In April, users streamed more than 373 million videos, a whopping 490-percent increase over the same period last year. Due to this increase, Hulu has become the second most popular online streaming video repository; only YouTube (which displays both studio and user-generated videos) eclipses it. The demographic of online viewers isn't merely comprised of teens and twenty-somethings, either; Nielsen estimates that 29 percent of Hulu's audience is made up of adults—ages 35 to 49—who are looking for long-form content, not just cute kittens and skateboarding mishaps. Hundreds of movies and thousands of TV show episodes have been available on YouTube's Shows and Movies channels since its April launch. Although YouTube wouldn't reveal the exact number of viewers it has, or the number of streams thus far, a representative from the popular video hub gave us a taste of its early impact: The world premiere of Wayne Wang's independent film The Princess of Nebraska was viewed more than 165,000 times during the first 48 hours that it was live; a number that Variety estimated was the equivalent of landing the 15th spot on Hollywood's weekly box office charts. "The business is changing fast," said Graham Bennett, YouTube's strategic partner manager. "We consider ourselves on the forefront. Clearly, online is the future." Hulu and YouTube are pushing the television-on-the-Web movement, but the question must be asked: Is forgoing cable TV, which can cost anywhere between $20 to well over $100 per month, for online television and movies a viable option for entertainment seekers?

Next: Should You Cut the Cable Cord? >> Should You Cut the Cable Cord? Pros & Cons. "I gave up cable in 2008 solely because I had maxed out three credit cards and didn't have money for it anymore," said Fairbanks. "It was either that or rent." Fairbanks discovered Hulu during her period of financial crisis, and enjoyed the service so much that she continued to use it in lieu of cable TV, even when she was long out of debt. She also traded in her pricey cable Internet subscription for Verizon DSL, which starts at just $19.99 per month.

Gabriel Fuentes is another online TV convert. The 30-year-old EMT trainee discovered Hulu while looking for a method to view episodes of Heroes that he had missed, and now says it commands at least 75 percent of his TV watching time. "Hulu's great for catching up on your favorite shows, and also discovering new shows," Fuentes said. "I discovered First 48, Kings, and Naruto there, and found it hard to go back to traditional television. I can watch when I want to watch without buying a DVR." A major drawback that's specific to most online television programming is the lack of a live feed. Typically you can't tune into, say, Fringe as it's being broadcast. And although you can usually stream live breaking news, such as a Presidential address, major events can result in online traffic jams. For example, although Hulu streamed the Michael Jackson memorial as it was happening, the amount of traffic to the site slowed the video to a crawl. "Sure, it sucks that I don't get to see shows live or as they occur, but it's okay because I can always catch it later," said Hines. "It's a trade-off, but it's worth it." Fuentes also sometimes misses live TV, because Web videos can kill the channel-surfing experience. "Every show starts at the very beginning of an episode, so you don't have an opportunity to sample a show as you would when you jump into the middle of one while changing stations," he said.

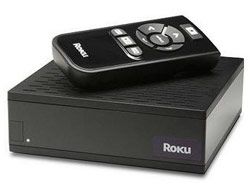

The current state of online television is basically that there's a variety of good content to watch, but not enough of it to attract the vast majority of couch potatoes. "Until the good chunk of content is online, there won't be much cord cutting," said Tim Twerdahl, vice president of consumer products for Roku, which makes the $99 Roku Video Player. "Popular channels such as Discovery and Food Network don't put that much online." However, the major players in online video are trying to close the gap between traditional and Web TV. For example, Roku now lets sports fans tune into live Major League Baseball games starting at $29.95 per year. The company's box also streams content from Amazon Video On Demand (www.amazon.com/videoondemand) and Netflix (starting at $8.99; www.netflix.com).

Stay in the know with Laptop Mag

Get our in-depth reviews, helpful tips, great deals, and the biggest news stories delivered to your inbox.

Next: New Cable Initiatives, Fees >>

Cable's New Initiatives: TV Everywhere, On Demand Online The biggest hurdle that Hulu and YouTube face may be the cable companies themselves, which are already home to some of the most popular movies and TV shows. In June, Time Warner announced a partnership with Comcast to develop TV Everywhere, a model that was created to extend cable programming to the Web—free and on demand—for existing customers. The goal is to allow subscribers to view their favorite programming via the Web, and offer deeper content than Hulu and YouTube.

As part of this initiative, Comcast announced that it would kick off national trials of its new On Demand Online service in July, which would bring A&E, BBC America, CBS, Discovery, HBO, IFC, Starz, TBS, TNT, and other cable channels to approximately 5,000 customers, and serve as a test run of TV Everywhere's authentication technology. The content is available at Comcast.com, Fancast.com, TBS.com, and TNT.tv. On Demand Online will function very much like traditional on-demand services offered today via cable TV; you select a show to watch from a selection of content to which you currently subscribe. If a given show has ads when you view that same content on your TV, ads will appear in the online version. Similarly, such premium channels as HBO will lack commercials when streamed through the Web. Although late to the game, services such as On Demand Online are designed to show entertainment seekers that they can get more content than online-only services—if they're willing to not cut the cord. But would cable providers consider letting costumers pay for strictly online content? Don't hold your breath. "Cable companies have an entrenched business model," said Roku's Twerdahl. "It's not in their DNA to deliver a Web-only experience." A cursory glance at On Demand Online may cause some to agree. While content from Hulu and YouTube can be viewed on any Web-connected notebook, Comcast's new service is not yet mobile. "Right now it's available in the home," said Kate Noel, senior manager for corporate communications for Comcast. "The authentication technology recognizes the user as a Comcast subscriber." Noel wouldn't comment on the possibility of allowing non-Comcast subscribers to sign up for the service, but she did say that Comcast was working to extend On Demand Live beyond the abode of its subscribers. Noel added that, despite this key limitation, there's much to like about On Demand Online. "We bring customers significantly more content than what's currently online," she said. "Customers can watch more TV in more places than ever before." Subscription Fees Coming?

With online advertising still in a slump and with cable companies looking to steal some of Hulu's thunder, could it just be a matter of time before Hulu pulls the plug on free online TV? Jonathan Miller, News Corporation's chief digital officer, has publicly stated that "the answer could be yes. I don't see why over time that shouldn't happen." News Corporation of course, is one of Hulu's backers. However, while it may seem inevitable that Hulu and YouTube will be forced to adopt a paid content model—at least as a premium option that supplies more content or less ads—some analysts believe that it will be a difficult transition. "It would be cool to pay $24.95 per month for all-you-can eat, or perhaps a pay-as-you-go plan, but that requires a strong infrastructure," said Roger Kay, president of Endpoint Technologies Associates. "It requires a lot of bandwidth, especially if you allow viewers access to full seasons." Kay believes that the ad-based models Hulu and YouTube currently employ are the best methods available to both, as neither company has a mechanism in place by which to accept payments. He stated that getting people to pay for content may be tricky, as not every studio may agree to participate. "Content owners can make the idea of a pay area difficult," he said. "Time Warner may do it, but Fox may not." Roku's Twerdahl agrees that Hulu and YouTube may not need to go pay. "Pay isn't inevitable; I think all models have a place," he said. "My take is that it's a matter of growing the audience."